Bill and Income Reminders, also referred to as scheduled transactions in Quicken, are more than just a reminders for your bills. They can also predict your future cash flow and see when your accounts are in danger of overdraft or low balances. Photoshop 2018 mac crack. If you are new to Bill. Last updated: Article ID: HOW25295. I am up to Quicken 2016 (after starting with Quicken 2000 for Windows), but switched all my computers to Mac in 2015. I needed a solution to run Quicken for Windows on Mac, and I eventually found CrossOver from CodeWeavers.

I've been thinking a lot about budgeting tools. When I first starting working, I kept a “Budget Bible” that tracked my spending down to the penny. It was easy because I was single, had few financial obligations, and plenty of time. Today, budgeting is harder and with less time for mundane tasks, I rely on automated tools.

When it comes to, I think Mint and Personal Capital are the clear leaders in the field. I wanted a head to head to head comparison to include one of the older entrants to the field,, which celebrates its 34th (!!!) birthday this year, because while free is the best price, it doesn't automatically make it the best service. If you're most interested in seeing a head to head of (let's be honest, Quicken isn't really in the running is it?). Table of Contents • • • • • Investing Tools Quicken and Personal Capital are the stars in this category, largely because Mint isn't an investment app, and therefore offers only incidental investment services. Quicken's Starter Edition does not include investing, but it's Premier Edition does. That edition provides features like their Portfolio X-Ray, showing performance vs.

The market of your investments, and help with with buy/sell decisions. It also provides up-to-date portfolio values, and tracks cost basis and capital gains.

Quicken also helps minimize taxes on your investments. The have a tool called the Capital Gains Estimator, that can help you optimize security sales to realize the greatest after-tax yield.

Mint is the weakest of the three platforms in the investing category, mostly since it is primarily a budgeting app. They do track your portfolio value, as they do with other accounts, but they don't provide specific tools to help you in your investing activities. Investing is what Personal Capital does best. The free version has a wealth of investment tools, including a Net Worth calculator and Cash Flow analyzer. The app will track your portfolio, balance your portfolio allocations, key holdings, and list your top gainers and losers.

They also offer unique tools, such as their Fee Analyzer. You can use it to analyze your investment accounts to see what fees you're really paying for the account. This can include broker fees, as well as the fees charged by mutual funds, that may be reducing your net investment return. Personal Capital also offers professional investment management for a fee.

You can have a portfolio created, maintained and managed for less than what it would cost to have your portfolio managed by a traditional investment advisor. Winner: because it does more than offer a tracking tool, you can use it's free analytical tools for a relatively deep dive into your investments. They will pitch you their investment advisory service, that's how the bills get paid, but you don't ever need to use them. Quicken performs admirably, especially given its tax reduction tools, but just hasn't kept pace. Budgeting Tools All three services offer budgeting and while there are similarities between each, there are plenty of differences worth noting.

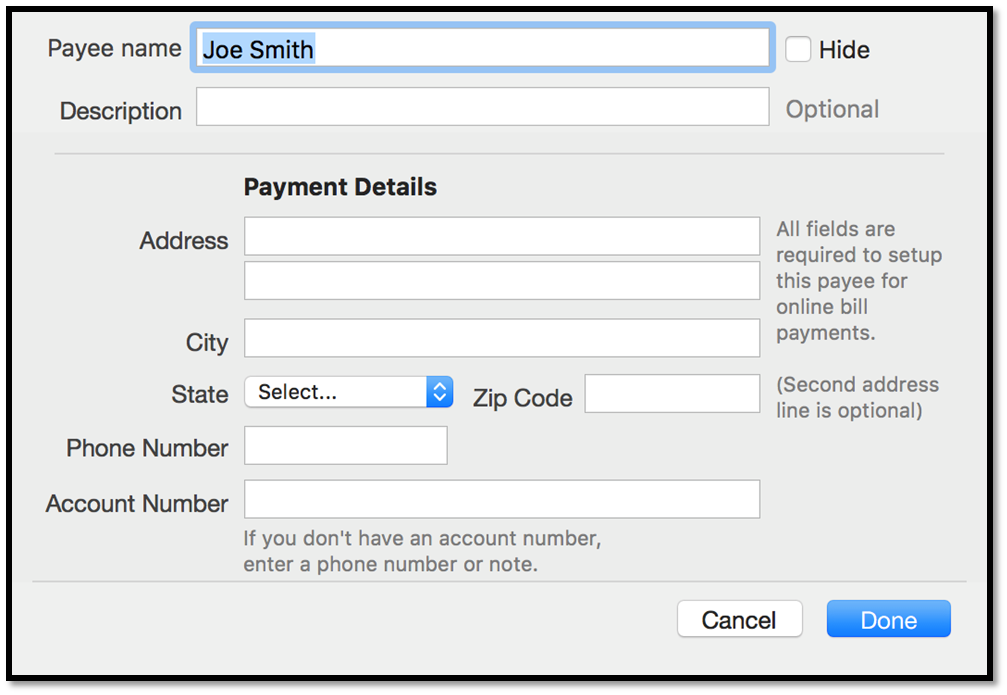

Quicken: Quicken provides a full budgeting suite. You can see, track and pay bills, all from the app. It shows both bank and credit card balances, and imports bank transactions securely. The app organizes your spending in categories, then projects income and expenses, helping you to create a budget. Like the other services, Quicken also reminds you when your bills are due.: Mint feels like it was designed for Millennials. Rather than simply track, it'll help with budgeting and debt management. It provides a breakdown of spending by category and allows you to put limits on your spending in each.

Mint then gives recommendations to help you save money. These offers, which you can think of really as advertisements, help pay for the service but also can save you money. This can include deals on insurance, credit cards, bank interest rates and credit cards too. The app can link up with literally thousands of financial institutions, including banks, credit cards, various lenders and investment brokerages. This provides you with automatic tracking of your financial activity, and all in one app. It will also provide alerts to remind you of upcoming bill due dates to help you avoid missing deadlines.: This service has a more limited budgeting capacity, since it's set up primarily as an investment management platform, with some budgeting services. The app will link to your bank accounts, credit accounts and investment accounts.